United States of America - CHIPS and Science Act

The US government is concerned about the transitory supply chain shortages of semiconductor chips that surfaced in 2020 and 2021 because of COVID-related problems. Furthermore, it also wants to scale down its reliance on East Asia, which accounts for 75% of global chip production. With the US CHIPS and Science act, it wants to implement an industrial strategy that revitalises domestic manufacturing, creates US jobs, strengthens US supply chains and accelerates the industries of the future.

What: Legislation

Impact Score: 1

For who: Policy Makers, Industry, business, researchers

Key Takeaways for Flanders

- In addition to the EU and US chips act, South Korea and China have also announced large-scale subsidies for the semiconductor industry. All of these policies threaten a race to the bottom in protectionist subsidies. In the short-term, each individual policy may attract domestic and foreign investment, but in the long-term, they will collectively make the manufacturing product more expensive—a cost sure to be passed along to consumers.

- To avoid wasteful subsidies, the US, EU and other like-minded countries and regions should explore the politics of partnerships.

URL: https://www.govinfo.gov/content/pkg/PLAW-117publ167/pdf/PLAW-117publ167.pdf

Summary: https://www.commerce.senate.gov/services/files/592E23A5-B56F-48AE-B4C1-493822686BCB

In-depth analysis of the context: https://carnegieendowment.org/2022/11/22/after-chips-act-limits-of-reshoring-and-next-steps-for-u.s.-semiconductor-policy-pub-88439

The bill has two main goals: increase semiconductor supply chain resilience (economic security & long-term US leadership in future innovation) and keep up with China's advancements and bring the most sophisticated technologies back to the US, from a national security perspective.

The bill should also be seen in conjunction with other measures taken by the US recently. For instance, it has announced a set of export regulations aimed at cutting off China from specific semiconductor chips made around the world with US equipment. In addition, the US is also putting pressure on other countries, such as Japan and the Netherlands, to tighten exports to China of equipment used to make semiconductors

The CHIPS and Science act is divided into three chapters:

- Division A: CHIPS Act of 2022 (Creating Helpful Incentives to Produce Semiconductors)

- Division B: Research and Development, Competition, and Innovation Act

- Division C: Supreme Court Security Funding Act of 2022

Division A: CHIPS Act of 2022 (Creating Helpful Incentives to Produce Semiconductors)

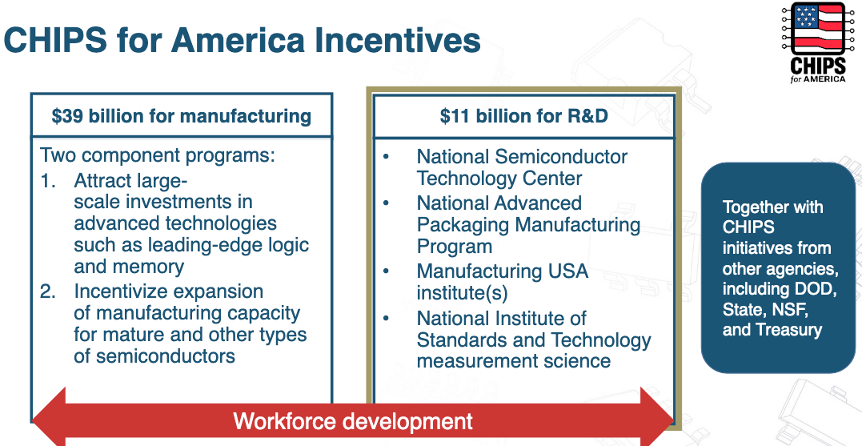

This chapter announces manufacturing, research and development incentives and investment tax breaks.

- CHIPS Act 2022 ($54.2 billion)

- The CHIPS Act 2022 includes $39 billion in manufacturing incentives to build, expand and modernize domestic facilities and equipment for semiconductor production, assembly, testing, advanced packaging or R&D. Manufacturing capacity is also being built up for suppliers to the semiconductor industry. Of that amount, $2 billion is set aside for mature semiconductors.

- On top of the $39 billion, $11 billion will be spent on R&D. From this, four elements should emerge:

- A National Semiconductor Technology Center: public-private partnership for manufacturing R&D, prototyping and workforce development

- A National Advanced Packaging Manufacturing Program: aimed at strengthening advanced assembly, test and packaging capabilities

- A Manufacturing USA Semiconductor Institute: a partnership between government, industry and academia to research machinery and capabilities

- Microelectronics Metrology R&D: research program to advance measurement and standards

- CHIPS for America Workforce and Education Fund ($200 million): development of semiconductor workforce

- CHIPS for America Defense Fund ($2 billion): workforce training and implementation of Microelectronics Commons

- CHIPS for America International Technology Security and Innovation Fund ($500 million): support international information and communications technology and security activities

- Public Wireless Supply Chain Fund ($1.5 billion): spur movement towards open-architecture, software-based wireless technologies

- Investment Tax Credit ($ 24 billion)

This element of the act provides a 25% investment tax credit to companies that invest in semiconductor manufacturing.

Division B: Research and Development, Competition, and Innovation Act (Science Act) ($169.9 billion)

Increasing global technology competition is causing US economic and national security headaches. US Federal R&D Spending as a percentage of the GDP is near its lowest point in over 60 years. This has dropped the US to 9th place in the world rankings, behind countries such as South Korea, Japan and Germany. The US, therefore, wants to drastically increase R&D funding and build new technology hubs in various places around the country. The budget provided will be divided between:

- National Science Foundation (NSF) ($81 billion): includes investments in Strategic Translational Science (investments in economic-security critical technologies), early-stage research, building STEM workforce, expanding rural STEM education and building broad-based research opportunities.

- Department of Commerce (DOC) Technology Hubs ($11 billion): the creation of 20 regional technology hubs that will focus on technology development, job creation and expanding US innovation capacity. This part also contains a project which will support persistently distressed communities with economic development subsidies.

- National Institute of Standards and Technology authorization: support for research devoted to standards development, strengthening small manufacturers, combatting supply chain disruptions, promoting competitiveness in International Standards and education and workforce development.

- National Aeronautics and Space Administration: Support to various space-related research programmes and projects

- Research Security to Protect Federal Investments in the US R&D Enterprise: This component should strengthen the National Science Foundation in security research and staff training

- Department of Energy Office of Science ($50.3 billion): Collects a range of incentives aimed at energy research and policy

- Additional Department of Energy Science and Innovation Provisions ($17.6 billion): Establishes a Foundation for Energy Security and Innovation at the DOE to foster partnerships among government, industry, startups, and outside funding organizations to increase funding opportunities from the private sector, accelerate commercialization of technologies, and provide workforce training in energy security and innovation fields.

Division C: Supreme Court Security Funding Act of 2022 ($ 20 million)

The total rank of incentives: $ 248.12 billion

Next steps

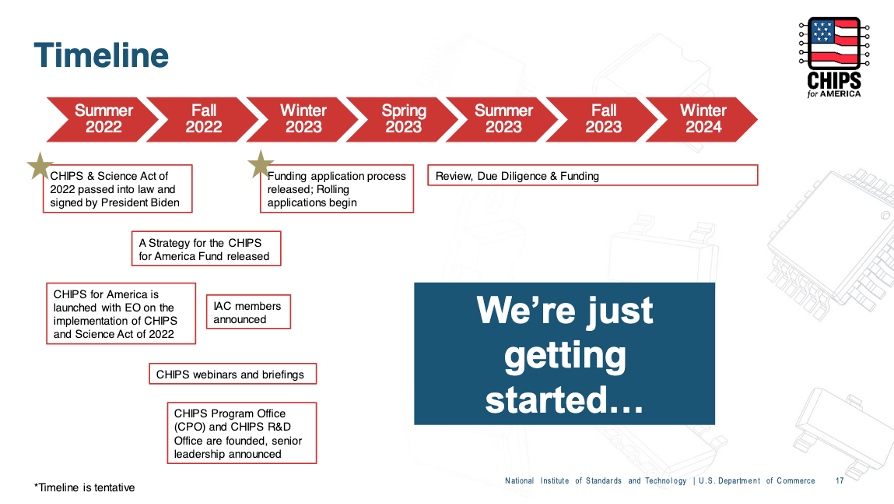

The US Government has drafted an implementation strategy. The implementation of the different programs of the CHIPS and Science act can be followed on the dedicated website CHIPS.GOV.